Rate On the first RM600000 chargeable income. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast chart statistics.

The Complete Income Tax Guide 2022

These businesses are subject to a 24 percent tax rate Annually.

. Small and medium-sized businesses SMEs pay a significantly different company tax from all resident businesses. Tax Rate of Company. For the purpose of the Malaysia corporate tax rate a small or medium company is one that is incorporated in the country.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business. Management and control are normally considered to be exercised at the place where the directors meetings concerning management and control of the company are held.

Malaysian corporations and LLPs are generally required to pay a corporate tax rate of 24. This is a smaller average than what we had the previous year. On the chargeable income exceeding RM600000.

Corporate Tax The common corporate tax rate in Malaysia is 25. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. Following table will give you an idea about company tax computation in Malaysia.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. 24 above MYR 600000. Corporate - Taxes on corporate income.

Bayaran Taksiran LBATA 24Aktiviti Bukan Perdagangan Company. On the First 5000. This rate is relatively lower than what we have seen in the previous year.

Chargeable income MYR CIT rate for year of assessment 20212022. An individual is considered tax resident if heshe is in Malaysia for 182 days or more in a calendar year. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast chart statistics. The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies.

Resident companies are taxed at the rate of 24 while those. The current CIT rates are provided in the following table. A company is tax resident in Malaysia if its management and control are exercised in Malaysia.

On the First 5000 Next 15000. Bayaran Taksiran LBATA 24Aktiviti Perdagangan 27. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020.

The rate of service tax is 6. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. 3 of audited income.

These companies are taxed at a rate of 24 Annually. What are the corporate tax rates in Malaysia. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information.

However in the case of a resident company the Malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non-resident. Tax Rate of Company. The ad valorem rates are 5 or 10 depending on the class of goods.

Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. Malaysian resident corporations trading in Malaysia are subject to the corporation tax Malaysia 2020. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million.

Corporate tax rate for resident small and medium-sized enterprises with capitalisation under MYR 25 million 17 on the first MYR 600000. Resident companies are taxed at the rate of 24. However if they have less than MYR25 million in paid-up ordinary share capital and less than MYR50 million in gross income they will be subject to a two-tier tax rate of 17 and 24.

Paid-up capital up to RM25 million or less. Last reviewed - 13 June 2022. Rate TaxRM A.

In general corporations are taxed on income derived from Malaysia with the exception for banking insurance air transport or shipping sectors.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Individual Income Tax In Malaysia For Expatriates

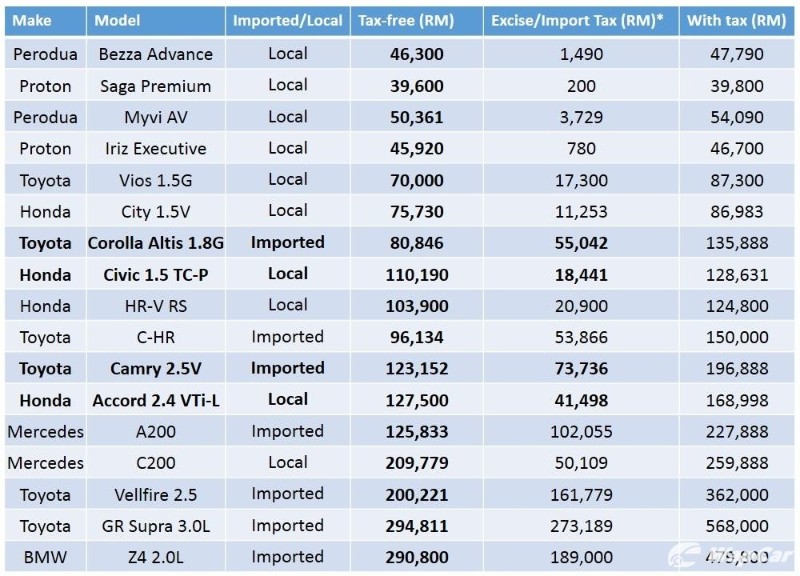

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Business Income Tax Malaysia Deadlines For 2021

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

7 Tips To File Malaysian Income Tax For Beginners

Everything You Need To Know About Running Payroll In Malaysia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

New York State Enacts Tax Increases In Budget Grant Thornton